How UPI is Becoming a Global Payment Revolution in 2025

Introduction

Five years ago, many Indians were still carrying cash, struggling with card payments, or waiting in long queues for remittances. Today, almost every shop, cab driver, and street vendor in India accepts UPI. With a simple scan of a QR code, anyone can make payments instantly.

But in 2025, UPI is no longer just India’s payment solution. It’s entering the global stage. Countries are adopting UPI technology, global merchants are accepting it, and NRIs are finding it easier to send money back home. In short, UPI is not just India’s pride—it is becoming the world’s blueprint for digital payments.

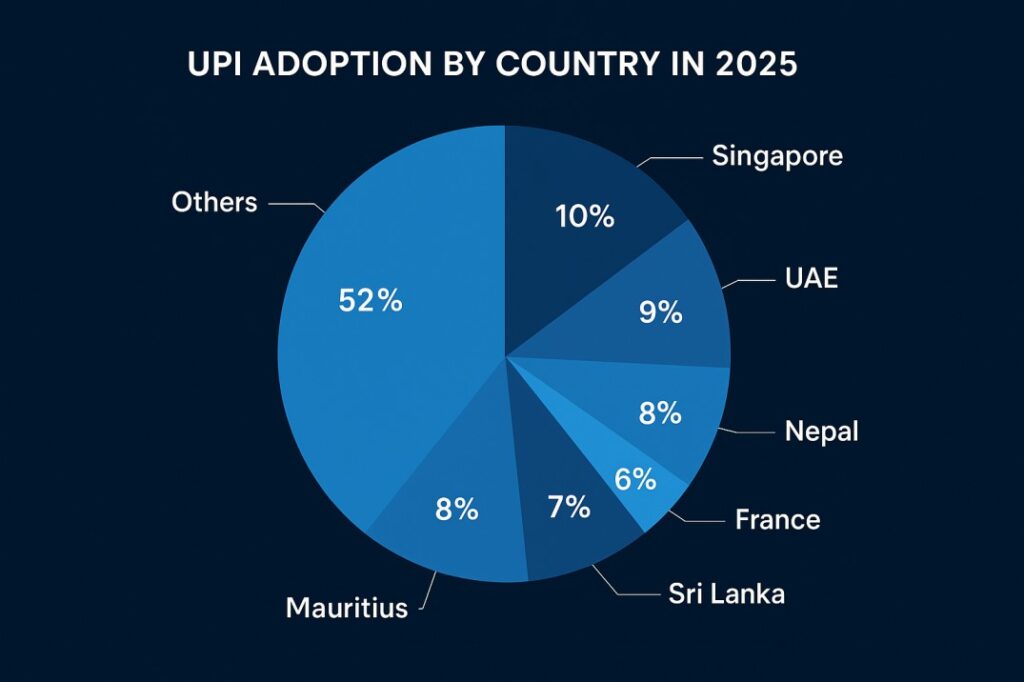

🌍 Countries Adopting UPI in 2025

India’s National Payments Corporation of India (NPCI) has been actively pushing UPI into global markets. Here’s a closer look at how different countries are adopting it:

1. Singapore

Singapore was one of the first countries to connect its PayNow system with India’s UPI. This partnership allows instant cross-border transfers between Indian and Singaporean bank accounts. For students, workers, and families, this means faster and cheaper remittances without waiting for days.

2. United Arab Emirates (UAE)

The UAE, home to millions of Indian expatriates, is rapidly rolling out UPI. Tourists can pay in malls, restaurants, and taxis using their UPI apps. For NRIs, UPI simplifies sending money back home without heavy bank charges.

3. Nepal

Nepal was the first country outside India to officially adopt UPI. Given the strong economic ties between India and Nepal, UPI helps ease trade, travel, and daily transactions.

4. France

Yes, even in the heart of Europe, UPI is making an impact. In Paris, Indian tourists can now pay at popular attractions like the Eiffel Tower using UPI apps. This shows how UPI is not just limited to Asia but is expanding to global tourist hotspots.

5. Sri Lanka & Mauritius

Recently, both Sri Lanka and Mauritius joined the UPI network. For Indian tourists and businesses, this reduces the dependency on expensive foreign exchange and card networks.

💡 Why UPI is Winning Globally?

The global financial system has long been dominated by Visa, Mastercard, and SWIFT. But UPI is breaking through because:

- Cost-Effective: UPI transactions are almost free, while card payments and remittances often come with 2–5% fees.

- Instant Transfers: No waiting for 2–3 days like traditional bank transfers.

- Mobile-First Design: Works with a simple QR code and smartphone—no need for expensive POS machines.

- Trust & Security: Backed by NPCI and RBI, with two-factor authentication and strong fraud detection.

- Inclusive for Small Businesses: Even a tea seller in a remote village can accept UPI, and the same model is inspiring vendors abroad.

📊 Case Study: UPI Adoption in UAE

The UAE has nearly 3.5 million Indians, making it a prime market for UPI. Before UPI, sending money from Dubai to India cost an average of 4–6% in fees. Now, with UPI-linked apps, remittances are almost free and instant.

Tourists also find UPI useful in Dubai malls and restaurants, where UPI QR codes are now accepted. This reduces the need to carry foreign currency or pay conversion charges on credit cards.

🔮 The Future of UPI by 2030

Experts believe UPI has the potential to become a global standard for digital payments. By 2030, we may see:

- More Countries Joining – NPCI is already in talks with countries in Europe, Africa, and Southeast Asia.

- Integration with CBDCs – Central Bank Digital Currencies being developed worldwide could connect with UPI.

- Alternative to Visa/Mastercard – UPI may not replace them but will act as a low-cost competitor, especially in emerging economies.

- Boost to Indian Economy – UPI’s global reputation makes India a leader in fintech innovation, attracting investments and partnerships.

📈 Analysis: UPI vs. Traditional Systems

| Feature | UPI | Credit/Debit Cards | SWIFT Transfers |

|---|---|---|---|

| Transaction Time | Instant | 1–2 Days (sometimes) | 2–5 Days |

| Fees | Almost Free | 2–5% | $20–$40 per transfer |

| Accessibility | Any smartphone | Requires POS machine | Bank visit required |

| Global Reach (2025) | 10+ countries | 200+ countries | 200+ countries |

👉 This comparison shows how UPI is faster, cheaper, and easier, especially for day-to-day use.

Challenges Ahead 🚧

While UPI is growing fast, it faces some hurdles:

- Regulatory Barriers: Every country has its own banking rules.

- Currency Conversion Issues: Seamless forex integration is still developing.

- Competition: Global players like Visa, Mastercard, and PayPal may lobby against UPI adoption.

Despite these challenges, UPI has already proven that it’s here to stay.

Conclusion

From being an Indian innovation in 2016 to becoming a global fintech leader in 2025, UPI has come a long way. Countries across Asia, the Middle East, and Europe are adopting it, NRIs are saving on remittance fees, and tourists are enjoying hassle-free payments abroad.

By 2030, UPI could well be known as the “digital rupee bridge to the world.”

FAQs

1. Can I use UPI abroad right now?

Yes, UPI is already available in countries like Singapore, UAE, France, Nepal, Sri Lanka, and Mauritius.

2. Will more countries adopt UPI in future?

Yes, many countries in Asia, Africa, and Europe are already in talks with NPCI.

3. Is UPI safe for international payments?

Yes, UPI uses strong encryption, two-factor authentication, and RBI-backed security measures.

4. Can UPI replace PayPal and Visa?

Not entirely, but it offers a cheaper, faster alternative especially in emerging markets.

5. Do foreigners visiting India use UPI?

Yes, tourists can now activate UPI wallets linked with their international cards to pay in India.

📢 Call to Action (CTA)

UPI has shown the world that India can lead in technology and finance. If you want to stay updated with the latest on digital payments, startups, and fintech news, subscribe to our newsletter and join thousands of readers who trust us for clear, smart, and timely updates. 🚀